By Chad Clark, Vice President, Regional Business Development Officer, Bank of America Practice Solutions 1

Acquiring an established dental practice is a significant milestone, but ensuring long-term success requires more than just securing the right location and patient base. New practice owners must surround themselves with a team of industry professionals who specialize in the dental field. These experts help navigate the complexities of ownership, from legal and financial considerations to insurance and compliance. Here are the key professionals every dentist should work with when acquiring a practice:

Dental-specific attorney

A dental specific attorney is essential in reviewing and negotiating the practice purchase agreement, lease agreements, and employment contracts. Unlike a general business attorney, one with dental experience understands the nuances of practice acquisitions, ensuring the terms protect your interests while complying with industry regulations. They also understand the industry and help structure agreements that minimize risk and future liabilities.

Practice transition consultant

A practice transition consultant helps navigate the logistics of ownership transition, including patient retention strategies, staff integration, and operational efficiency. They ensure a smooth handoff between the previous owner and the new dentist, minimizing disruptions to the business.

Dental specific lender

Financing a practice acquisition requires more than just a business loan. A lender who specializes in dental practice financing understands the value of goodwill, patient retention, and practice cash flow. Dental lenders offer tailored loan structures with favorable terms, often including working capital, equipment financing, and competitive interest rates to support your growth.

Insurance broker specializing in dental practices

An experienced insurance broker, like FDA Services, helps news owners secure the right types of insurance coverage, including:

- Malpractice insurance – protecting against legal claims

- Business owners’ policy (BOP) – covering property damage, liability, and business interruptions

- Disability and life insurance – providing financial security for the owner and their family

- Workers’ compensation – ensuring compliance and state regulations and protecting employees

Choosing an insurance agent who understands dental specific risks ensures comprehensive protection.

Dental CPA (certified public accountant)

A dental CPA provides specialized financial expertise tailored to dental practices. They assist with:

- Practice valuation – ensuring the purchase price aligns with the practice’s true financial performance

- Tax planning – identifying deductions and structuring the purchase for optimal tax benefits

- Cash flow management – helping new owners understand financial trends and budget for expenses

A dental CPA ensures that you not only acquire the practice but also set it up for financial success.

Dental equipment and technology specialist

Even when acquiring an established practice, technology upgrades may be necessary. A dental equipment and technology specialist helps assess existing equipment, recommend upgrades, and ensure seamless integration of digital systems like electronic health records (EHRs), imaging software, and patient management tools.

In conclusion

Acquiring a dental practice is a major investment, and surrounding yourself with theright team of professionals ensures a smooth transition and long-term success. By working with industry-specific experts including a dental attorney, CPA, lender, insurance broker, and transition consultant, new owners can mitigate risks, streamline operations, and focus on providing excellent patient care. Establishing this network early on sets the foundation for a thriving and profitable practice.

Call Chad Clark, Senior Vice President, Regional Business Development at chad.clark@bofa.com or 813.599.44978 for more information.

Bank of America, N.A. provides these articles for your discussion or review purposes only. Please consult your financial, legal, and accounting advisors, as neither Bank of America, nor its affiliates or employees provide legal, accounting or tax advice.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, includingBank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc. which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

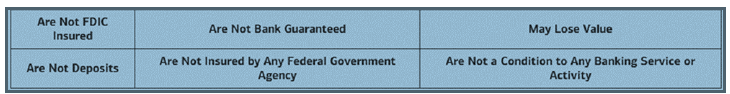

Investment and Insurance Products:

Bank of America is committed to the protection of personal information we collect and process. For more information about how we protect your privacy, please visit ( http://www.bankofamerica.com/privacy). California residents may have additional rights and you can learn more at http://www.bankofamerica.com/ccpa-notice.

Bank of America Practice Solutions is a division of Bank of America, N.A. Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. ©2025 Bank of America Corporation.